Korea Blockchain Week 2018, Seoul, July 16 to 20, 2018

Building Cryptocurrency Networks

Understandably, the dramatic upsurge in cryptocurrency use culminated in the Korea Blockchain Week 2018, featuring multiple events and conferences, designed towards bringing potential and successful investors together.

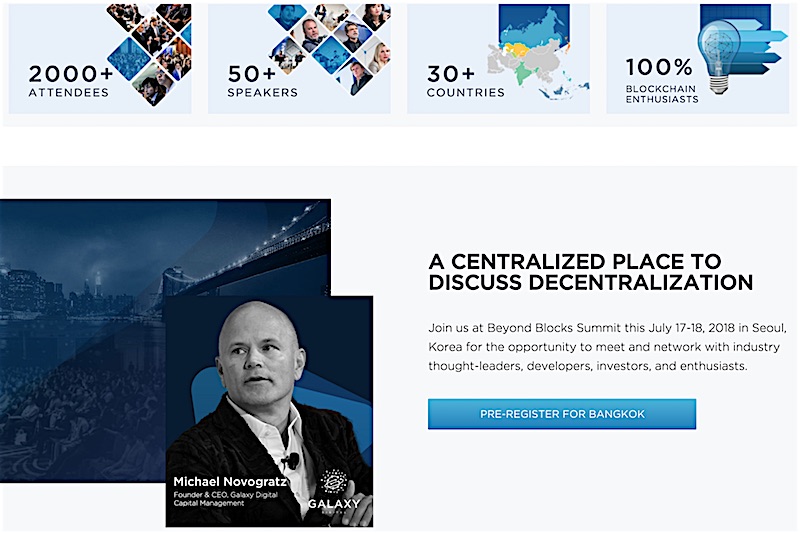

50 speakers, from over 30 countries, met in Seoul KBW 2018 to discuss the prospects of the cryptocurrency industry and ways to implement blockchain technology further. The Beyond Blocks Summit also had discussions and lectures on similar topics, thereby forming a network of like-minded Blockchain and crypto enthusiasts.

Many of these speakers were also people I had contracted to speak at the Japan Blockchain Conference 2018. I was in Seoul during this exciting event, attending some meetings of my own. I met with Wall Street billionaire Michael Novogratz (CEO of Galaxy Digital) who is partnered with Bloomberg, as well as, Scott Walker and Dave Siemer of DNA and Genesis, to work on global expansion partnerships and generating cross-border capital markets. Incidentally, the co-founder of DNA Brock Pierce also happened to be a keynote speaker at JBC 2018.

A Look At South Korea’s CryptoBoom

You’ve probably heard of kimchi. But, have you heard of the Kimchi Premium? It represents South Korea’s fascination for cryptocurrency, which makes coins cost anything up to 30% higher there than anywhere else in the world.

In December 2017, Bitcoin hit the $10000 mark on South Korean exchanges, way before it could happen in the U.S.A! That’s not all. All the cryptocurrency trade carried out by South Korean residents in 2018, also deemed to be the third most traded currency worldwide, for Bitcoin, and almost at par with the dollar for Ether, even though the Korean population is much smaller in size than that of the US.

Probable Triggers

May 2017 saw Samsung, one of the most influential companies in South Korea declaring its intentions to utilize the Ethereum software for corporate purposes, turning into a potentially triggering incident for the cryptocurrency boom there. Samsung’s joining of the Enterprise Ethereum Alliance was very much the official green signal for Koreans to hurriedly start investing in the virtual currency market.

Additionally, the country has always been known for its brilliant technology, and wider citizen access to devices like smartphones, as well as, services like the internet. As suggested by indigenous currency exchanges like Korbit, this impressive level of South Korean virtual connectivity also allowed the fever to spread far and wide.

In 2017, South Korea accounted for more than 33% of the global exchange market for Ether, with around one million registered daily traders of cryptocurrencies. Two of the world’s top digital currency exchanges, Coinone and Bithumb, went on to have offline counters, where interested people can simply walk in to invest!

Alongside, the lack of high-return investment opportunities in the country also pushed people towards virtual currency, in the hopes that their profits will be better.

Paving the Way Forward

It was rousing to see the enthusiasm in Seoul regarding virtual currency. Of course, as with any trend, there are certain pitfalls. As suggested by Jeff Paik of Finector, in Seoul, a large section of traders are older pensioners rather than people from the tech world, which has led to cryptocurrency becoming a social fad.

Instead of trading because of the coin’s underlying technology, resulting in the tradings being rather ‘illogical’, so to say. However, on the brighter side, summits and conferences like KBW 2018 bring hope for a more informed investment future for South Korea.